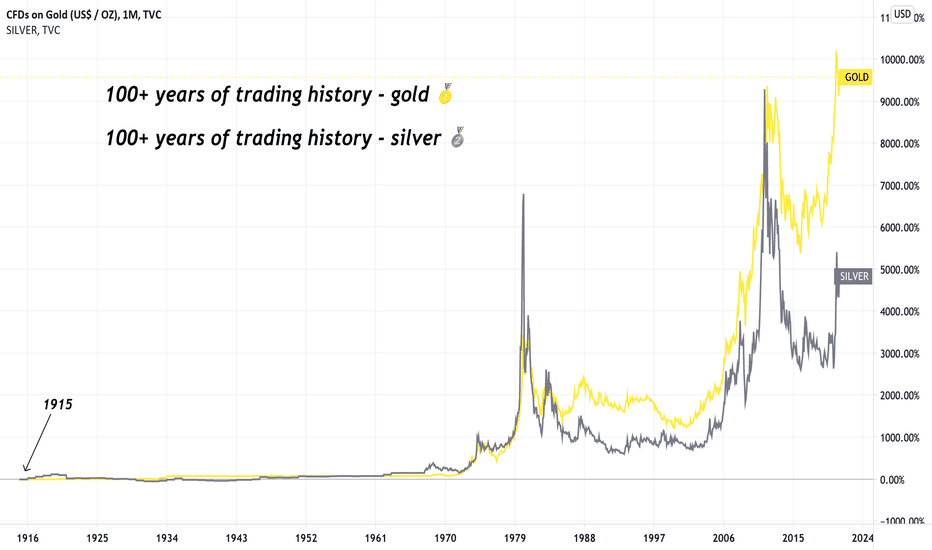

Gold has long been a highly prised precious metal, known for its lustrous appearance, unique properties, and historical use as a form of currency. While many global currencies were once backed by gold under the gold standard, this system was abandoned in the UK in 1931. However, gold continues to hold value as a stable asset, especially during times of economic uncertainty. With the global demand for gold steadily increasing, investing in or trading gold has become an attractive proposition for many investors.

Before you start trading gold, it’s crucial to have a solid understanding of the different types of gold assets available. These assets can involve physically owning the metal or trading it without possession.

Physical Gold

The traditional method is to buy physical gold, which can include gold bullion, coins, or jewellery. However, this option requires security measures, logistics, and insurance, making it more common among banks and financial institutions rather than individual investors.

Spot Price Purchasing

This involves buying or selling gold upfront at the current market price per troy ounce. It allows active investors to gain exposure to gold without physical ownership.

Gold Futures

Futures contracts establish a fixed price for gold and specify a future date for the exchange. Investors speculate on market movements to achieve profitable returns.

Gold Options

Unlike futures, gold options do not require an exchange but provide the option to do so. There are two types: calls (buyers have the right to exchange) and puts (sellers have the right to exchange).

Gold ETFs

Exchange-traded funds (ETFs) are passive investments that track the movement of a basket of shares in gold-related companies. They offer investors broader exposure and portfolio diversification.

Gold Stocks

Investing in gold stocks involves buying shares in companies involved in gold production, mining, funding, or sales. Gold stocks may not always correlate directly with the price of gold, requiring a nuanced understanding of their price trends.

To trade gold successfully, it’s important to grasp the factors that influence its price movements. Some major drivers include:

Mining

Gold mining affects the supply of new gold in the market. Although gold can be recycled, it remains a finite resource, and mining activity has slowed down globally. As demand increases and mining reserves dwindle, prices are likely to rise.

Demand

Gold demand has consistently increased over the years, driven primarily by jewellery consumption and gold ETFs. As supply declines, demand becomes a critical factor impacting gold prices.

Global Currencies

Gold often exhibits an inverse relationship with major world currencies, such as the US dollar, Japanese yen, or British pound. When gold rallies against these currencies, it is considered an opportune time to buy gold.

Interest Rates

Interest rate fluctuations affect gold prices. Rising interest rates tend to lower gold’s value as investors shift towards fixed-income assets. Conversely, declining interest rates drive investors back to the perceived security of gold.

Political, Economic, and Security Issues

Gold is considered a safe haven investment during times of market volatility, political instability, financial stress, or global events like the COVID-19 pandemic. These factors can cause significant spikes in gold prices. On the other hand, periods of economic prosperity and positive financial markets may reduce the demand for gold in favour of other assets.

Based on your investment goals and risk tolerance, select the most suitable method for trading or investing in gold:

After practicing with a risk-free demo account, you can start trading in live markets by creating a live Forex account. Setting up an account with VT Markets is a straightforward process, taking just a few minutes, even for beginners.

With your trading or investment account, you’ll have access to various tools, technologies, and market analysis. Platforms like MetaTrader 4 and MetaTrader 5 offer features to help you identify the right opportunity for trading gold based on technical indicators and market trends.

When opening a gold trade, it’s essential to manage risk and avoid overexposure. Implement tools like stop-loss orders or limit-close orders to automatically close your trade when it reaches a predetermined threshold. Depending on your strategy and outlook, choose between spot trading, gold futures, gold options, gold ETFs, or gold stocks.

Monitor your trade’s profit or loss position using the trading platform’s powerful tools. Stay informed about broader market trends and make informed decisions to close your position at an advantageous point according to your investment and trading strategy.

If you’re ready to embark on your gold trading journey, VT Markets is an ideal platform offering exceptional customer service and an intuitive trading platform accessible from your computer or mobile device. Whether you want to learn how to trade gold, access market analysis, or receive Forex signals, VT Markets simplifies the process of market trading. Create your gold trading account today or contact us for further information about our trading tools.