In the fast-paced world of Forex trading, where fortunes can be made or lost in the blink of an eye, the importance of selecting the right trading approach cannot be overstated.

Today, over 70% of traders rely on algorithmic trading methods, as revealed by the research report “Predictive Assessment of Electronic Trade Dynamics: 2022-2027“. This staggering statistic underscores the prevalence and influence of algorithmic trading in the contemporary financial landscape.

Understanding the nuances of both manual and algorithmic trading is crucial for non-professional traders to navigate these complexities successfully. Let’s delve into these approaches, exploring their intricacies and uncovering the key considerations that can shape the success of Forex trading.

Involving a traditional, hands-on approach where traders rely on intuition and market analysis, manual trading provides a unique learning experience and enables the exercise of emotional control.

This method offers a practical learning environment, allowing traders to engage directly with the market. For instance, envision a trader meticulously analysing historical price charts, identifying key support and resistance levels, and anticipating a trend reversal based on a combination of technical indicators and economic factors.

Actively participating in decision-making processes, manual trading helps traders develop emotional control – a crucial aspect of success. Consider a scenario where a trader, faced with a sudden market downturn, resists the impulse to panic sell and instead relies on their analysis to make rational decisions, avoiding potentially significant losses.

However, manual trading has its challenges. The time-intensive nature demands constant attention, making it challenging for traders with busy schedules. Emotional challenges remain prevalent, and the limited capacity for multitasking can hinder a trader’s ability to seize multiple opportunities simultaneously.

To illustrate, imagine a manual trader who, after studying market conditions, identifies a potential breakout in a currency pair. This trader monitors the charts, patiently waiting for the opportune moment to enter the market. When the anticipated reversal occurs, the trader executes a well-timed trade, capitalising on insights gained through hands-on analysis.

In essence, manual trading offers a personalised and engaging experience for traders willing to invest time and effort into understanding the intricacies of the Forex market. While it requires discipline and focused attention, the skills acquired through manual trading can be invaluable for those seeking a deep connection with their trading strategies.

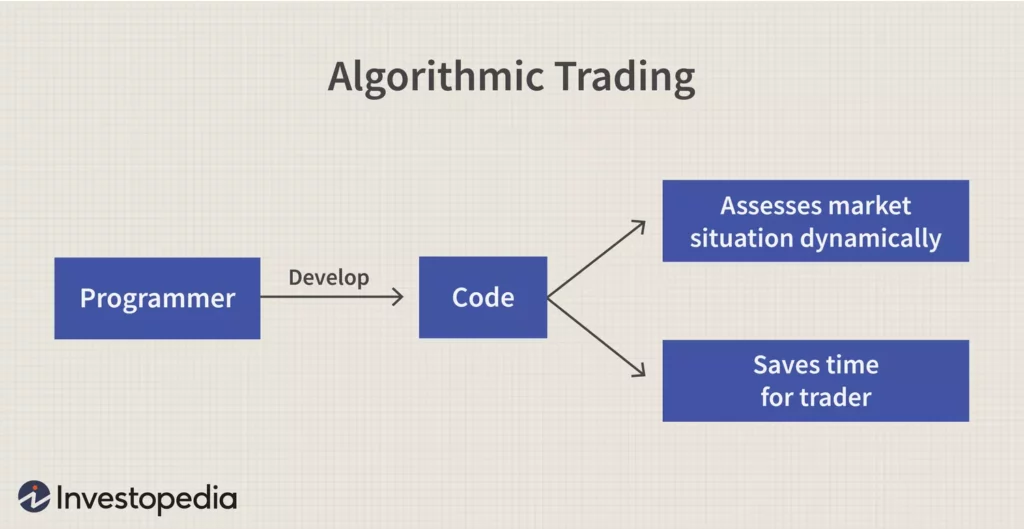

In stark contrast to manual methods, algorithmic trading relies on automated execution and data-driven decisions, emphasising speed, efficiency, and systematic strategy application.

Algorithmic trading excels in speed and efficiency, processing vast market data in milliseconds. An example is an algorithm identifying and capitalising on price discrepancies across markets, executing trades instantaneously.

Crucial to algorithmic trading, backtesting validates strategies using historical data, minimising the risk of flawed analysis. Imagine a trader developing an algorithm identifying profitable trends through historical price movements, ensuring viability before live application.

Despite its advantages, algorithmic trading has complexities. A steep learning curve demands proficiency in programming and data analysis. Over-reliance on historical data poses risks, as strategies may lose effectiveness in rapidly changing markets.

Consider a trader developing a sophisticated algorithm with machine learning techniques, allowing anticipation of price movements accurately and consistently yielding profits by adapting to evolving market conditions.

Algorithmic trading comes with risks, including system failures and technical challenges. Traders must be vigilant to address potential issues promptly, as glitches or failures could lead to unintended consequences.

In essence, algorithmic trading offers an efficient, systematic approach to Forex trading. Despite technical demands and potential risks, a well-designed algorithm has the potential to unlock consistent profits in the ever-evolving financial landscape.

When faced with the decision between manual and algorithmic trading, a careful evaluation of several key factors can significantly impact your trading journey.

Factor 1. Risk Tolerance:

Factor 2. Time Commitment:

Factor 3. Skill Level:

In summary, align your trading approach with your risk tolerance, time commitments, and skill set to make an informed decision between manual and algorithmic trading.

For example, a computer science-savvy trader might excel in algorithmic trading, leveraging programming skills. Meanwhile, a trader attuned to market psychology may find success in manual trading.

Each method has unique benefits, ensuring a strategic fit for your preferences and enhancing your success in Forex trading.

As technology and trading methodologies evolve, the concept of hybrid trading has emerged as a compelling strategy for traders seeking the best of both worlds. By combining manual and algorithmic approaches, traders can capitalise on the strengths of each method, creating a versatile and adaptive trading strategy.

Intuitive Decision-Making with Efficiency

Hybrid trading combines manual intuition with algorithmic efficiency. Traders leverage the strengths of both approaches – making informed decisions based on market understanding while benefiting from the speed and precision of automated execution.

Risk Management at the Core

Central to hybrid trading is robust risk management. Traders can swiftly adapt to changing market conditions by switching between manual and algorithmic modes. This dynamic approach enhances risk mitigation, allowing traders to navigate diverse market scenarios with agility.

A trader, combining economic insight with sentiment analysis algorithms, may switch between manual and algorithmic modes based on market events. This adaptability ensures critical decision-making during unexpected situations.

Continuous Adaptation and Learning

Hybrid traders embrace continuous adaptation and learning. The synergy between manual and algorithmic methods enables real-time strategy refinement, crucial in the ever-changing Forex market.

Optimising Strengths, Minimising Weaknesses

By combining manual and algorithmic trading, traders aim to optimise strengths while mitigating weaknesses. Manual trading adapts to unique market conditions, while algorithmic trading provides efficiency in executing predefined strategies.

VT Markets welcomes traders of all styles, whether engaging in manual or algorithmic trading.

For manual traders, the user-friendly interfaces of MT4, MT5, and WebTrader Plus ensure a seamless and intuitive experience across Forex, indices, commodities, and other assets. Execute trades with precision and efficiency, empowered by real-time data and analytical tools.

Alternatively, for those who prefer automated strategies, leverage the platform’s compatibility with expert advisors. Implement finely-tuned algorithmic approaches tailored to the nuances of your preferred instrument and aligned with unique trading objectives.

In conclusion, both manual and algorithmic trading have their merits and drawbacks. Forex traders should explore both approaches, considering factors such as risk tolerance, time commitment, and skill level. Embracing a hybrid strategy and leveraging the tools and opportunities provided by platforms like VT Markets can empower traders to navigate the Forex market successfully. Continuous learning and adaptation are key in this ever-evolving financial landscape.