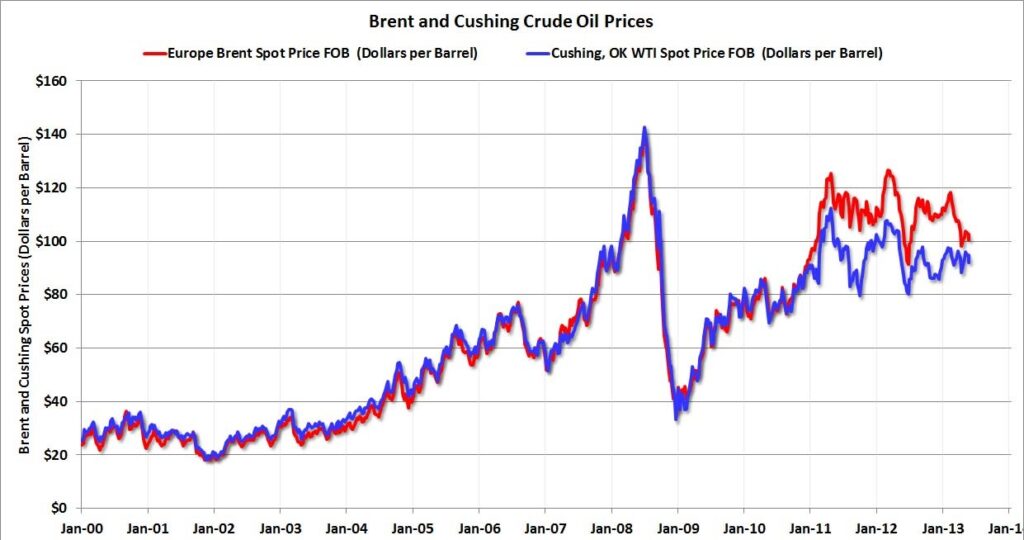

The oil and gas industry encompasses different types of oil, such as crude oil, no-lead gasoline, natural gas, and heating oils. Among these, crude oil remains the largest and most widely traded sector, sourced from various points of origin worldwide.

Due to its extensive trading volume and diverse sources, crude oil is susceptible to geographic, political, and economic factors that make its market highly volatile. This volatility presents both risks and opportunities for traders interested in capitalising on the oil market.

CFDs are derivative financial products that allow traders to gain exposure to a market, such as oil, without owning the underlying asset.

Unlike physical trading, oil CFDs derive their profitability from speculating on price fluctuations rather than the buying and selling of the actual commodity.

Successful trading of oil CFDs requires a deep understanding of market trends, factors driving price movements, and the ability to predict market dynamics.

Oil CFDs enable traders to access the expansive oil market through leverage, offering increased exposure without the need to possess the physical asset.

This increased exposure can diversify investment portfolios and reduce overall risk. Oil CFDs serve as conduits for trading in oil spot prices, oil futures, and oil options.

The most commonly traded benchmarks for crude oil CFDs are West Texas Intermediate (WTI) and Brent Crude Oil.

When trading oil CFDs, it is important to familiarise yourself with the two primary types of crude oil in the global market: WTI Crude Oil and Brent Crude Oil.

These crude oils are rated based on their density and sulphur content, which impacts their quality and refining costs.

To start trading oil CFDs, it is essential to follow a structured approach:

Step 1. Familiarise Yourself with Live Trading

Choose whether you want to trade WTI Crude Oil, Brent Crude Oil, or both. Practice using a demo account to become familiar with trading tools, indicators, and executing trades in a risk-free environment.

Step 2. Create Your Oil CFD Trading Account

Once comfortable with the trading environment, open a live trading account, download the trading platform, and deposit funds to start trading.

Step 3. Manage Your Risk

Establish risk management strategies, including the use of stop-loss orders and limit-close orders, to control potential losses.

Step 4. Study the Market

Deepen your understanding of the oil market through comprehensive research, including fundamental and technical analysis. Stay updated with breaking news and monitor long-term performance to identify patterns.

Step 5. Formulate a Strategy

Determine whether you prefer short-term or long-term trading strategies and select an approach that aligns with your portfolio and goals.

Step 6. Consider Diversification

Explore other CFD markets and assets to diversify your trading portfolio and mitigate risk.

Step 7. Monitor and Adjust

Continuously monitor your trades, adapt your strategy as needed, and make informed decisions based on the market conditions.

In addition to trading spot prices, oil CFDs also provide access to oil futures. Oil CFD futures are over-the-counter derivatives based on future contracts. These contracts allow traders to speculate on the future price of oil at a predetermined date. Trading oil CFD futures involves understanding the intricacies of futures markets, contract expiration, and factors that influence their prices.

Pros and Cons of Oil CFDs

As with any trading method, oil CFDs have their own advantages and disadvantages, which you’ll need to weigh up before you get started.

Pros:

Cons:

VT Markets is a provider of comprehensive trading services, offering demo trading accounts using the popular MetaTrader platforms. These demo accounts enable traders to experience realistic trading environments, access powerful trading tools, analyse market trends, and receive professional support. By leveraging these resources, traders can develop their trading style and gain confidence in trading oil CFDs effectively.

Summary: