Imagine a scenario where you could anticipate market movements with a high degree of accuracy, giving you an edge in the Forex trading world. Seasonal trading is one such technique that offers this potential advantage.

Just like the changing seasons influence various aspects of our lives, the Forex market also experiences recurring patterns and trends. By understanding and leveraging these seasonal patterns, traders can make informed decisions and potentially increase their profits.

Seasonal trading in Forex refers to the practice of identifying and capitalising on predictable price movements that occur during specific periods of the year.

It is based on the understanding that certain events, both economic and non-economic, tend to recur annually, leading to consistent patterns in the Forex market. These patterns can be attributed to a variety of factors, including economic cycles, political events, cultural celebrations, and even geographical or weather-related influences.

Seasonal patterns in Forex are influenced by a range of factors. Economic events such as interest rate decisions, GDP releases, and employment reports can have a significant impact on currency values. Political events, such as elections or changes in government policies, can also create predictable patterns in Forex trading. Furthermore, cultural events like major holidays and festivities can result in shifts in market sentiment and trading volumes.

There are two main types of seasonal patterns in Forex: calendar-based and event-based.

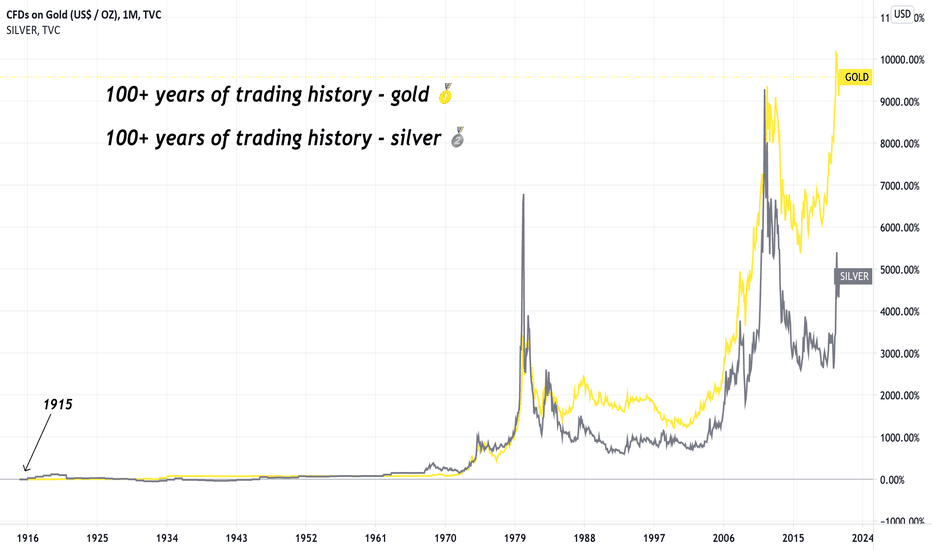

Historical data plays a crucial role in identifying and understanding seasonal patterns in Forex. By analysing past price movements and market behaviour during specific timeframes, traders can uncover recurring trends and tendencies.

This historical analysis provides valuable insights into potential trading opportunities, allowing traders to make more informed decisions based on patterns that have shown consistency over time.

Seasonal trading is valuable when market cycles, recurring patterns, and notable seasonal trends occur in Forex. These situations include:

Let’s explore some examples of seasonal trading patterns in Forex:

Holiday-Related Patterns

Major global holidays, such as Christmas, New Year, or Easter, can significantly impact currency pairs. For instance, the U.S. dollar often experiences increased volatility during the Thanksgiving holiday due to reduced liquidity and trading volumes.

Seasonal Economic Cycles

Quarterly or yearly economic cycles can create predictable patterns in currency values. For instance, the Japanese yen tends to strengthen during Japan’s fiscal year-end in March, as companies repatriate profits.

Commodity-Related Patterns

Certain currencies have correlations with commodity prices. For instance, the Canadian dollar often moves in tandem with oil prices. By understanding seasonal patterns in commodity markets, traders can anticipate corresponding movements in currency pairs.

Political Events and Elections

Elections and political events can have a significant impact on currency values. The lead-up to an election and the subsequent results can create volatility and trends. Traders can take advantage of these patterns by aligning their positions accordingly.

Geographical and Weather-Related Patterns

Certain industries and currencies are influenced by seasonal factors, such as tourism or agricultural activities. For example, the Australian dollar may be affected by weather conditions and their impact on the country’s agricultural output.

To enhance seasonal trading strategies, traders can employ advanced techniques such as:

To succeed in seasonal trading, consider the following strategies:

1. Conduct Thorough Research and Analysis: Invest time in studying historical data, market trends, and the factors that drive seasonal patterns. This knowledge will enable you to make well-informed trading decisions.

2. Use Proper Risk Management Techniques: Implement risk management strategies such as setting stop-loss orders and diversifying your portfolio to protect against unexpected market movements.

3. Stay Updated with Current Market Information: Stay abreast of economic calendars, news releases, and events that may impact seasonal patterns. Being well-informed allows you to react quickly to market changes.

4. Combine Seasonal Trading with Other Analysis Methods: Incorporate technical and fundamental analysis into your seasonal trading strategies for a more comprehensive approach.

5. Regularly Evaluate and Adapt Seasonal Trading Strategies: Continuously assess the performance of your seasonal trading strategies and make necessary adjustments based on market conditions and changing patterns.

Pros and Cons of Seasonal Trading Technique

Let’s explore the advantages and disadvantages of seasonal trading:

Pros:

Cons:

In conclusion, Seasonal trading in Forex provides traders with a unique opportunity to capitalise on recurring patterns and trends in the market. By understanding the dynamics of seasonality, identifying influential factors, and analysing historical data, traders can develop effective strategies to enhance their trading performance.

Remember to conduct thorough research, stay updated with current market information, and regularly evaluate and adapt your seasonal trading strategies. Use VT Markets risk-free demo account for testing your strategies. By doing so, you can potentially increase your chances of success in the dynamic world of Forex trading.