Imagine you’re an avid traveller planning your dream vacation to an exotic destination. As you excitedly exchange your hard-earned currency for the local money, you suddenly realise that there’s more to this transaction than meets the eye.

The exchange rate alone doesn’t determine the outcome of your trade; there’s a whole world of opportunities to explore. This is where the concept of Carry trading steps in, opening doors to potential profits in the foreign exchange market.

Carry trading involves borrowing a currency with a low-interest rate to invest in a currency with a higher interest rate. Traders aim to profit from the interest rate differential between the two currencies.

To grasp Carry trading, we need to understand interest rate differentials—the primary driving force behind this strategy. Interest rate differentials refer to the gap between interest rates in two countries. When there’s a substantial interest rate difference between two currencies, traders can capitalise on the higher-yielding currency and generate profits over time.

Currency pairs commonly used in Carry trades include those involving the Japanese yen (JPY) due to its historically low interest rates. Popular examples include JPY/AUD (Japanese yen/Australian dollar) and JPY/NZD (Japanese yen/New Zealand dollar).

Carry trading thrives in specific market conditions, creating opportunities for astute traders. Let’s paint a vivid picture to understand these situations better.

Imagine a scenario where Country A’s economy is booming, experiencing robust growth and stability. The central bank of Country A decides to raise interest rates to control inflation. Simultaneously, Country B is facing economic challenges, resulting in a sluggish economy and low-interest rates set by its central bank.

In this case, a favourable environment for Carry trading emerges. Traders can borrow the currency of Country B, which offers low-interest rates, and invest in the currency of Country A, where higher interest rates are available. By doing so, they can potentially earn the interest rate differential between the two currencies, increasing their profits.

To put it in simpler terms, let’s say you borrow the currency of Country B, let’s call it the B-Dollar (BDL), with an interest rate of 1%. You then convert your BDL into the currency of Country A, the A-Peso (AP), which offers an interest rate of 5%. Holding this Carry trade position means you earn the 4% interest rate differential annually.

In addition to interest rate differentials, other factors contribute to favourable Carry trading conditions. Economic stability, low inflation rates, and a positive risk appetite in the market all enhance the attractiveness of Carry trades.

Of course, it’s crucial to conduct thorough research and monitor economic indicators to identify these favourable situations accurately. Stay informed about interest rate decisions, economic reports, and geopolitical developments that can impact the currency markets. By identifying these ideal conditions, you can position yourself to capitalise on Carry trading opportunities and potentially enjoy handsome returns.

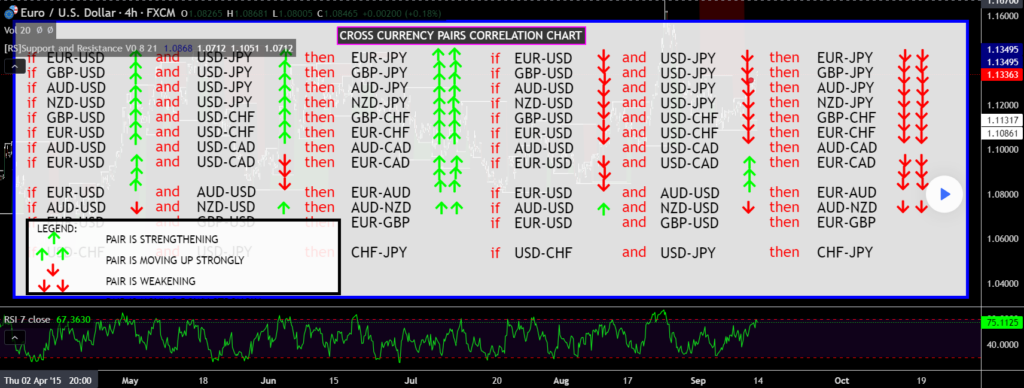

Currency correlations refer to the relationship between two currency pairs. Understanding these correlations is crucial for Carry traders. When two currency pairs have a positive correlation, they tend to move in the same direction. Conversely, negative correlations indicate that the currency pairs move in opposite directions.

Considering currency correlations helps traders diversify their portfolios effectively. By selecting currency pairs with low correlation, traders reduce their exposure to risk and increase the potential for profitable trades.

Technical analysis plays a vital role in Carry trading. By analysing price charts and using various indicators, traders gain insights into potential market trends and make informed trading decisions. Some common technical indicators include moving averages, oscillators, and chart patterns like support and resistance levels.

For example, the moving average crossover strategy helps identify trends. When a shorter-term moving average crosses above a longer-term moving average, it suggests a bullish trend, indicating a potential opportunity for a Carry trade.

Long-term vs. Short-term Carry Trading

Carry trading can be approached from a long-term or short-term perspective.

Choosing the right time frame depends on individual trading goals and risk tolerance. Long-term Carry trading tends to be more suitable for investors seeking stable returns over time, while short-term Carry trading may appeal to those comfortable with higher volatility.

Carry trading requires careful consideration during significant economic events that can disrupt currency markets. Let’s explore an example to understand the importance of navigating these events effectively.

Imagine the central bank of Country X is about to announce its monetary policy decision. Speculations suggest an interest rate increase to control inflation. As a Carry trader, you hold a long position in Country X’s currency, expecting the interest rate differential to work in your favour. However, the central bank surprises the market by keeping rates unchanged. This unexpected decision causes a sharp currency decline.

During such events, staying informed and adjusting strategies are crucial. Traders who anticipate volatility, set stop-loss orders, or take advantage of market movements can mitigate losses or find new opportunities.

To succeed in Carry trading during economic events, stay updated on major announcements, economic indicators, and geopolitical developments. Adapt your strategy, manage risk effectively, and seize opportunities that arise from market disruptions.

Carry trading has its advantages and disadvantages. Let’s explore them briefly.

Pros:

Cons:

To engage in effective Carry trading, consider the following tips:

Conduct Thorough Research

Stay informed and up-to-date on economic news, monetary policies, and market trends. This will help you identify suitable currency pairs for Carry trades that align with your trading strategy and risk appetite.

Diversify Your Portfolio

Avoid putting all your eggs in one basket by trading multiple currency pairs. Diversification spreads the risk across different economies and currencies, reducing the impact of potential losses from a single trade.

Set Appropriate Stop-loss Orders

Implementing stop-loss orders is crucial in managing risk. These orders automatically close your position if the trade moves against you, limiting potential losses. Set stop-loss levels based on your risk tolerance and the specific characteristics of the currency pair you are trading.

Implement Risk Management Strategies

Besides stop-loss orders, consider incorporating other risk management techniques into your trading plan. This may include using take-profit levels, trailing stops, or adjusting position sizes based on market conditions.

Exercise Caution with Leverage

Leverage can amplify both profits and losses in Carry trading. While it allows you to control larger positions with a smaller amount of capital, it also increases the risk. Carefully assess and understand the implications of using leverage before employing it in your trades.

In conclusion, Carry trading offers an intriguing opportunity to profit from interest rate differentials in the forex market. By borrowing low-yielding currencies and investing in higher-yielding ones, traders can potentially maximise their profits. Understanding market conditions, currency correlations, and employing effective strategies like technical analysis are crucial for success.

However, traders should also be aware of the risks involved and exercise caution in their trading activities. With careful planning, research, and risk management, Carry trading can be a valuable addition to any forex trader’s toolkit.

Summary: