Gold, often referred to as the “King of Metals,” has consistently held a paramount position in the world’s economic landscape, transcending mere aesthetics and luxury.

A prime example underscoring gold’s critical role in the global economy lies in the significant gold reserves central banks maintain. These financial linchpins of nations uphold these reserves as a testament to gold’s unparalleled value, a tradition spanning centuries.

During the height of the late 19th and early 20th-century gold standard era, major economies like the United States anchored their currencies to gold, solidifying the stability of the global financial system.

For instance, the U.S., a major economic power at the time, boasted one of the largest gold reserves, officially holding approximately 20,663 metric tons of gold as of 1939, just before the outbreak of World War II. A considerable portion of this gold was securely housed at Fort Knox in Kentucky, a renowned depository.

Gold, beyond its charm, stands as a financial cornerstone, bolstering stability, credibility, and global relations. Appreciating its cultural, economic, and historical worth requires understanding its extensive history. Gold’s journey across civilisations reveals its enduring allure and lasting impact on human history.

Gold, one of the most coveted metals in history, has captivated humanity for millennia. Its appeal can be traced back to ancient civilisations such as the Egyptians, Greeks, and Romans, holding immense cultural, economic, and aesthetic value.

In ancient Egypt, gold was revered as the “flesh of the gods,” symbolising divine power and immortality. Egyptians widely used gold for various purposes, including currency, jewellery, and religious artifacts. Pharaohs were often buried with vast amounts of gold, a testament to its

The Greeks, too, held gold in high esteem, associating it with gods and considering it indestructible due to its non-reactive nature. This perception elevated gold to a divine status, reinforcing its prominence in society.

In ancient China, gold held immense cultural and economic value. It was used for ornamental purposes, religious offerings, and even as a form of currency during various dynasties. The Chinese associated gold with prosperity and believed it brought good luck.

India has a deep-rooted cultural affinity for gold, considering it auspicious and a symbol of purity and prosperity. Gold is an integral part of weddings, festivals, and religious ceremonies, often passed down through generations as heirlooms.

During the Spanish conquests in the 15th and 16th centuries, significant gold reserves were uncovered in regions now known as Mexico, Peru, and parts of Central and South America.

Legends like El Dorado drove Spanish explorations, leading to the discovery of abundant gold, especially in present-day Colombia, Venezuela, and the famed silver mines of Potosí in Bolivia.

The influx of gold from the Americas significantly altered global gold supply, affecting trade dynamics and gold’s value worldwide. The wealth from the Americas financed wars, fuelled industries, and facilitated the rise of powerful merchant families, causing a price revolution and laying the foundation for modern banking systems.

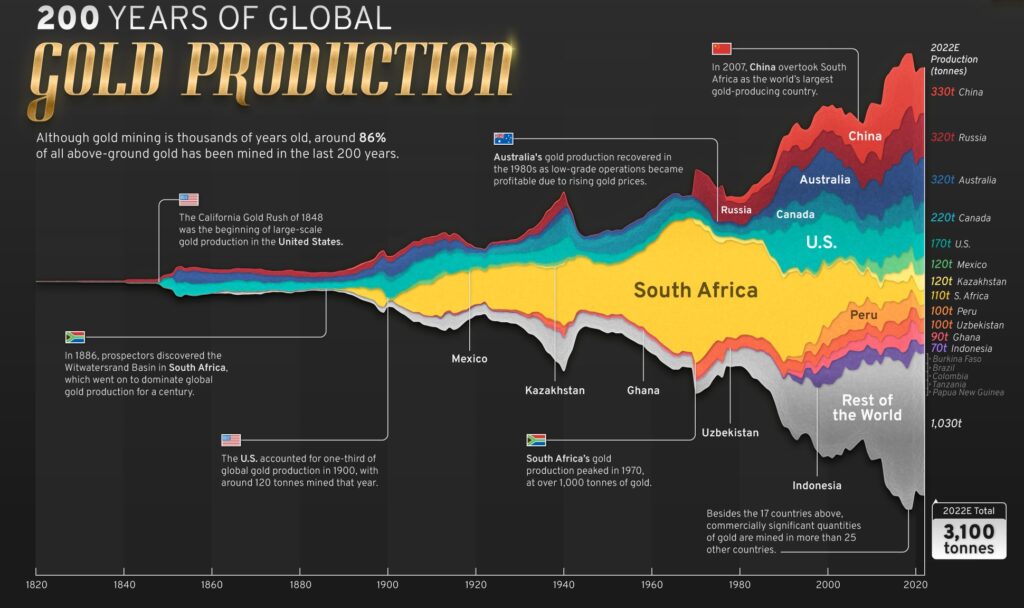

The 19th century witnessed the phenomenon of gold rushes, forever altering the course of history. The California Gold Rush (1848-1855) and the Australian Gold Rush (1851) were pivotal events that ignited economic booms, sparking population growth and advancements in mining technologies.

These gold rushes acted as magnets, attracting people from around the globe in search of wealth. The influx of people led to the rapid development of cities, infrastructure, and entire economies in these regions, leaving an enduring mark on their landscapes.

In response to the surging demand for gold, miners and prospectors developed innovative mining technologies and techniques. These advancements not only revolutionised the mining sector but also had a broader impact, driving progress in industrial and engineering domains.

The late 19th and early 20th centuries witnessed the widespread adoption of the gold standard, anchoring the value of a nation’s currency to a specific quantity of gold. This system instilled confidence in the monetary system and promoted financial stability.

Under the gold standard, each unit of currency was backed by a fixed amount of gold held in reserve, providing a sense of security to holders of that currency. This ensured that the paper currency had tangible value tied to a precious metal.

However, the gold standard’s rigidity became apparent, especially during economic downturns. Governments found it challenging to implement flexible monetary policies to combat economic crises. Consequently, nations began transitioning away from the gold standard, opting for more adaptable monetary systems.

The 20th century, marked by the two World Wars, saw a surge in gold demand. Governments and individuals sought gold as a safe-haven asset during times of uncertainty. Post-World War II, gold played a crucial role in shaping the global monetary system, evolving into its significance in the 21st century as a safe-haven asset amid economic volatility and geopolitical tensions.

In recent years, gold has maintained its status as a safe-haven asset, particularly during economic downturns and geopolitical instability. Its value surged after the 2008 financial crisis, highlighting its resilience and enduring relevance in the modern financial landscape.

Gold, often revered as a timeless symbol of wealth and prosperity, continues to wield immense influence in the contemporary global economy. Explore how this precious metal remains an enduring force, shaping the dynamics of the modern economic landscape.

Central banks play a pivotal role in maintaining a stable modern global economy. Gold reserves held by central banks are a fundamental component, providing a solid foundation for economic stability and bolstering a nation’s creditworthiness. These reserves act as a safeguard, particularly during economic downturns and emergencies, instilling confidence in the financial system.

Key players in the global financial landscape, including the United States, Germany, and the International Monetary Fund (IMF), uphold substantial gold reserves. For instance, as of 2023, the United States holds the largest gold reserves globally, amounting to approximately 8,133 metric tons. Germany comes in second with about 3,355 metric tons, followed by the IMF with approximately 2,814 metric tons. These extensive holdings underscore gold’s enduring importance in the modern economic framework, showcasing its resilience and relevance.

In the contemporary world, gold is universally acknowledged as a reliable hedge against economic uncertainty. Its historical status as a safe-haven asset is reinforced during times of economic turbulence, be it inflation, deflation, geopolitical instabilities, or financial crises. Investors turn to gold, seeking a secure investment that can effectively preserve their wealth in volatile market conditions.

Notably, the demand for gold escalates during economic crises, as it is perceived as a safe bet amidst market volatilities. For example, during the 2008 financial crisis, gold prices surged from around $800 per ounce in 2008 to over $1,900 per ounce in 2011, demonstrating its value as a safe-haven asset during tumultuous times.

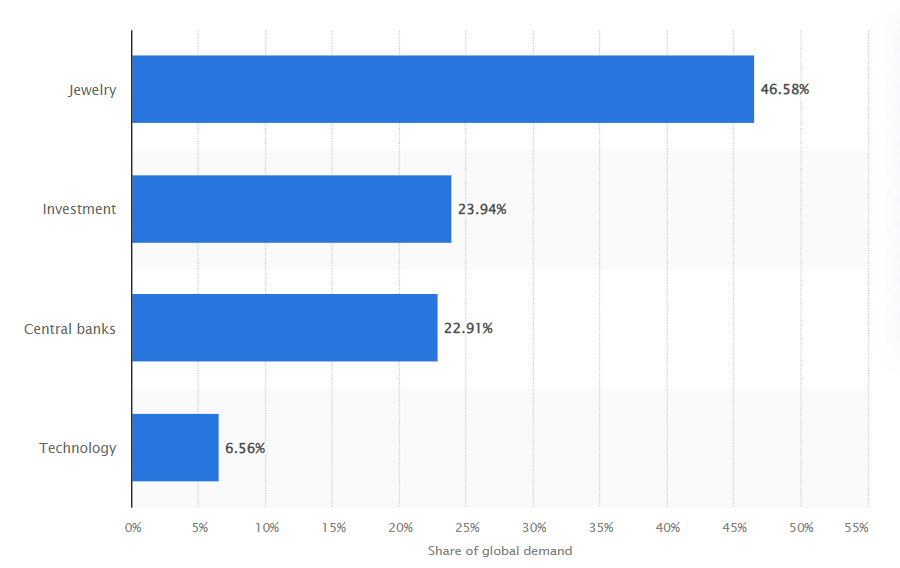

Gold’s influence extends far beyond its traditional role. In the contemporary global economy, gold plays a multifaceted and indispensable role. Gold is not only a store of value and a safe-haven asset; it’s widely used in different sectors, making it even more important.

In the realm of jewellery, gold is not just a symbol of opulence but also a representation of tradition and cultural significance. In 2022, the global demand for gold in the jewellery sector amounted to approximately 2,086 metric tons.

Its exceptional conductivity properties make it a vital component in the electronics industry, contributing to the production of various technological devices. Furthermore, its unique attributes make gold indispensable in specialised applications like aerospace technology and medical devices.

Numerous factors intricately affect gold prices in the global market, including supply-demand dynamics, economic indicators, geopolitical events, currency strength, central bank policies, market speculation, and industrial demand. Understanding these influences is crucial for comprehending gold market dynamics.

In conclusion, comprehending gold’s historical journey unveils not only its economic implications but also its profound impact on our lives and businesses. Gold symbolises human creativity, resilience, and adaptability. It acts as a bridge across generations, a timeless emblem that continues to influence our world, connecting our past, present, and future. As we navigate the complexities of economics and trade, the enduring value of gold in the tapestry of humanity remains a constant and compelling reminder.